Telematics Black Box Car Insurance - Pros & Cons

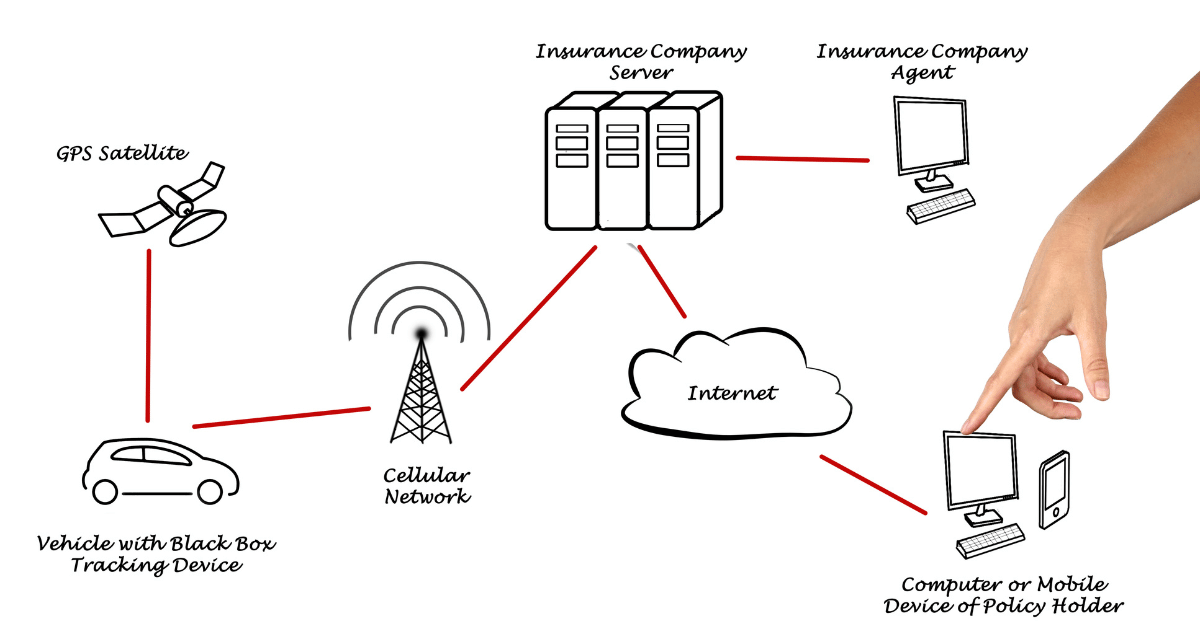

Telematics technology is becoming increasingly popular in the car insurance industry in the UK. A telematics black box car insurance policy is a type of insurance policy where a small device, also known as a black box, is installed in your car to track your driving behavior. This article will discuss the pros and cons of a telematics black box car insurance policy in the UK and help you make an informed decision.

Pros:

-

Lower Insurance Premiums: A telematics black box car insurance policy rewards good driving behaviour with lower insurance premiums. The insurance company will analyze your driving habits, such as speed, acceleration, and braking in order to create an overall driving score. The insurer then uses this score to adjust your premiums up or down. If you are a safe driver, you could see significant savings on your car insurance premiums.

-

Improved Driving Behavior: Knowing that your driving is being monitored can motivate you to be a safer driver. A telematics black box car insurance policy encourages drivers to be more cautious, avoid risky behavior, and drive more responsibly, ultimately making the roads safer for everyone.

-

Theft Recovery: In the unfortunate event that your car is stolen, the telematics black box can help the police locate and recover your vehicle. The device tracks your car's location, and the insurance company can alert the authorities if your car is moved without authorization.

-

Accurate Claims: In the event of an accident, the telematics black box can provide valuable data about the incident, including the speed and direction of impact. This data can help the insurance company settle claims quickly and fairly, and prevent fraudulent claims.

Cons:

-

Privacy Concerns: The telematics black box records your driving behavior, including your location and driving habits. Some people may feel uncomfortable with the idea of being constantly monitored, and worry about how their data is being used.

- Restrictions & Curfews: Many telematics policies have specific terms and conditions that dictate when and how much you can drive. For example, some policies impose a curfew on driving between certain night-time hours to prevent you driving in the dark. Others may include mileage limits such as 5,000 miles per year.

-

Limited Choice: Telematics black box car insurance policies are not widely available from all insurance providers in the UK. This limits your choice of insurance companies, and you may not be able to find the right policy to suit your needs.

-

Upfront Costs: There may be an upfront cost to install the telematics black box in your car. Some insurance companies offer free installation, while others may charge a fee. This cost may deter some drivers from choosing this type of insurance policy.

- Additional Fees: When taking out a telematics policy be sure to read the extra fees you may incur. In particular, the extra miles fees are often the biggest issue for many black box drivers. Once you get close to your mileage limit you will likely get a warning to cut down your driving or to purchase extra miles. The extra miles cost can vary between providers so be aware of this from the outset.

-

Technical Issues: The telematics black box relies on technology, and there is always a risk of technical issues. If the device malfunctions, it may impact your insurance premiums or result in inaccurate data being recorded.

Conclusion

Overall, a telematics black box car insurance policy has its pros and cons. The policy can save you money on your insurance premiums, encourage safe driving behaviour, and provide valuable data in the event of an accident or theft. However, privacy concerns, limited choice, upfront costs, extra fees and technical issues are potential drawbacks to consider. Young drivers in particular can benefit from telematics policies but as you get older you may find that the restrictions and the cost mean a standard policy is more suitable. Ultimately, you should weigh the pros and cons carefully and choose the policy that best suits your needs and preferences.

SAVE up to *£504 on Car Insurance

- Cheap Car Insurance Quotes

- Save time: 120+ companies compared

- Monthly & Annual Payment Options

SAVE up to *£504 on Car Insurance

OVER 120+ PROVIDERS COMPARED